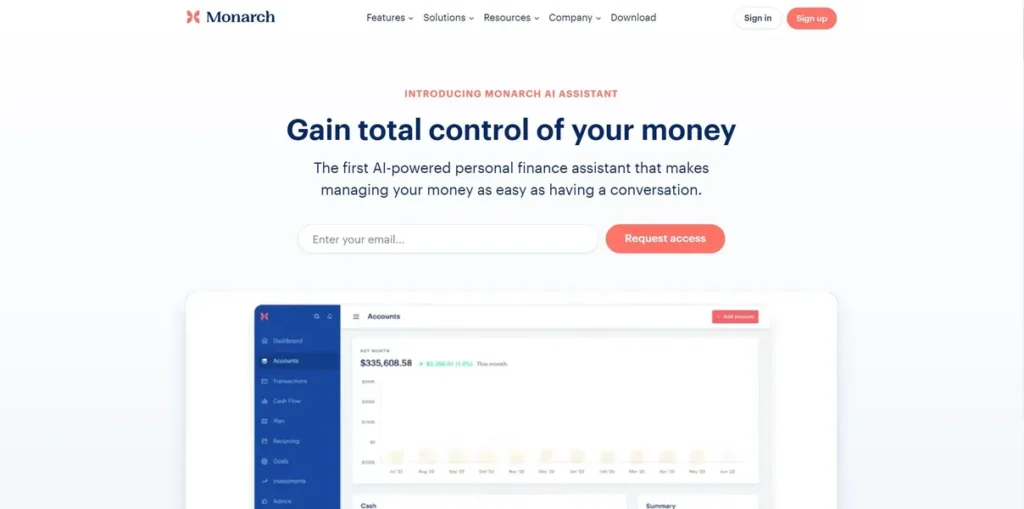

What is Monarch Money?

Monarch Money is a sophisticated financial management platform that acts as a central command center for your entire financial life. For professionals accustomed to data-driven dashboards, Monarch provides a similar holistic view of personal assets, liabilities, and cash flow. It aggregates account balances, transactions, and investments into a single, cohesive interface, eliminating the need to juggle multiple apps. By leveraging AI for data organization and offering robust tools for goal setting, it empowers users to move beyond simple tracking and into strategic financial planning. Whether accessed via web, iOS, or Android, Monarch is designed for clarity and control, helping you manage your financial KPIs with precision.

Key Features and How It Works

Monarch’s power lies in its suite of integrated tools designed to streamline financial oversight and planning. It operates by connecting securely to your financial institutions, then cleaning and organizing the incoming data to provide actionable insights.

- AI-Driven Transaction Organization: The platform automatically categorizes your transactions with impressive accuracy, saving hours of manual data entry. For marketing managers, this is akin to an automated lead-tagging system; you can set custom rules to ensure every expense and income source is correctly allocated, providing a clean dataset for budget analysis.

- Comprehensive Investment Tracking: Monarch consolidates all your investment accounts—from 401(k)s to brokerage accounts—into one dashboard. It allows you to monitor performance, analyze asset allocation, and track your net worth against your goals, effectively measuring the ROI of your capital.

- Collaboration Features: This is where Monarch truly excels. You can securely invite a partner or financial advisor to your dashboard. Think of it like a shared Google Analytics dashboard for your household’s finances. You and your partner can view key metrics and reports, ensuring everyone is aligned on the strategy without sharing sensitive login credentials.

- Flexible Budgeting and Goal Setting: Move beyond rigid, static budgets. Monarch allows for customizable budget categories and offers rollovers, so unspent funds from one month can be allocated to the next. This is perfect for managing the variable budgets common in campaign workflows, allowing for flexibility while keeping an eye on the annual target.

- Custom Dashboards and Reports: Tailor your view to focus on the metrics that matter most to you. Whether you’re tracking cash flow for a side hustle or monitoring progress toward a down payment, you can build reports that provide the exact insights you need, much like creating a custom report in a marketing analytics platform.

Pros and Cons

Every platform has its strengths and weaknesses. Here’s an objective look at Monarch Money.

Pros

- Unified Financial View: Consolidating all accounts into one dashboard provides a powerful, at-a-glance understanding of your complete financial picture.

- Seamless Collaboration: The ability to securely share access with a partner or advisor at no extra cost streamlines joint financial planning and decision-making.

- High Degree of Customization: From transaction rules to dashboard widgets, the platform can be tailored to fit specific and complex financial situations.

- Privacy-Focused Model: With a subscription-based model, Monarch does not sell user data or display ads, ensuring a secure and focused user experience.

Cons

- Onboarding Curve: The sheer number of features means there is an initial time investment required to learn the platform and customize it effectively.

- Mobile Experience Discrepancy: While the mobile app is highly functional, some advanced features and customization options are more intuitive on the web version, which may impact users who are primarily mobile-first.

Who Should Consider Monarch Money?

Monarch Money is best suited for individuals and families who are serious about taking a data-driven approach to their finances. It’s an ideal fit for:

- Data-Driven Professionals: Individuals who appreciate having a comprehensive, 360-degree view of their financial KPIs to make informed decisions.

- Couples and Families: Partners who want to collaborate on shared goals, manage household budgets, and maintain transparency in their financial planning.

- Freelancers and Entrepreneurs: Those managing multiple or variable income streams who need robust tools for tracking cash flow, categorizing business expenses, and planning for taxes.

- Former Mint Users: Anyone looking for a more powerful and customizable alternative to simpler budgeting apps, with superior investment tracking and no ads.

Pricing and Plans

Monarch Money operates on a freemium model, providing a trial period to explore its capabilities before committing to a subscription.

- Free Trial: A 7-day free trial is available, offering full access to all Premium features.

- Premium Plan: Priced at $14.99 per month or an annual subscription for a discounted rate, this plan unlocks all features, including unlimited account connections, goal setting, investment tracking, and collaboration.

Disclaimer: Pricing is subject to change. Please visit the official Monarch Money website for the most current information.

What makes Monarch Money great?

Monarch Money’s most powerful feature is its seamless collaboration, allowing partners and advisors to operate from a single source of financial truth. While other platforms offer account aggregation, Monarch builds upon this foundation with a design philosophy centered on shared financial management. This collaborative core, combined with its highly customizable and AI-driven organizational tools, transforms personal finance from a solitary chore into a coordinated strategy. The commitment to a premium, ad-free experience further solidifies its position as a serious tool for those who view their financial health as a critical project to be managed with the best data available.

Frequently Asked Questions

- How does Monarch Money ensure my data is secure?

- Monarch uses bank-level security, including read-only access to your accounts and robust encryption. They do not sell user data and their subscription model aligns their interests with protecting your privacy.

- Can my partner and I manage our finances together on Monarch?

- Absolutely. Monarch’s collaboration feature is a key differentiator. You can invite your partner to your household account at no extra cost, allowing both of you to view and manage your shared financial picture.

- Is Monarch Money a good alternative to Mint?

- Yes, for many, it’s a significant upgrade. Monarch offers more in-depth investment tracking, greater customization with transaction rules and dashboards, and a premium, ad-free experience, making it a compelling choice for users who have outgrown Mint’s capabilities.

- Can I track all my assets, including real estate, in Monarch?

- Yes, Monarch allows you to add manual accounts to track the value of assets like real estate, vehicles, or other valuables, providing a more accurate calculation of your total net worth.