What is Numra?

For a small business owner, time spent on manual finance work is time not spent on growth. Numra is an AI-powered finance assistant designed to take over these repetitive, time-consuming tasks. It functions as a digital team member that handles routine financial operations, such as data entry, account reconciliations, and processing invoices. The core value proposition is straightforward: let software manage the tedious but critical financial legwork, so you and your team can focus on strategic decisions. It aims to increase your finance department’s capacity and accuracy without the cost of hiring additional staff.

Key Features and How It Works

Numra’s effectiveness comes from a set of practical, targeted features that address common financial bottlenecks. Understanding how they work is key to evaluating its potential return on investment.

- Intelligent Automation: At its heart, Numra automates processes. You can feed it large Excel or CSV files, and it will execute complex tasks like three-way matching for invoices or performing bank reconciliations. It also handles routine monthly tasks like calculating and posting prepayments and accruals, which directly reduces manual effort at the close of each period.

- Seamless Integrations: A major concern for any new software is how it fits with existing tools. Numra is built to connect with the systems you already use, including ERPs, CRIs, banking portals, and even email. This means it can pull data from one source, process it, and push the results into another without requiring you to abandon your current accounting or customer management software.

- Internal Controls and Auditing: Automation without oversight is a risk. Numra provides a clear audit trail for every action it takes. It generates detailed logs and reports, and you can implement approval workflows. This ensures that while the task is automated, a human still has the final say, maintaining compliance and control.

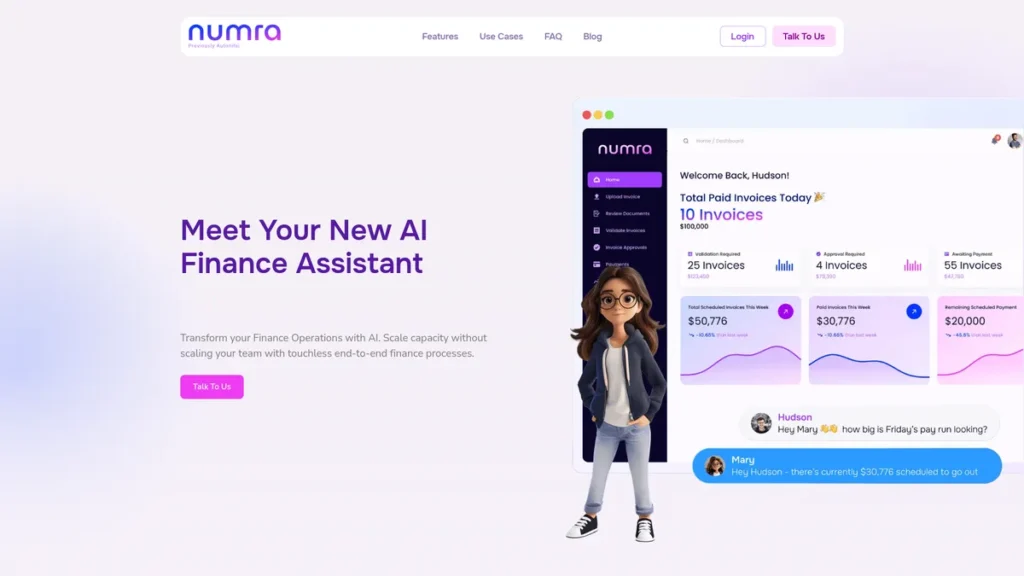

- Centralized Platform: All of Numra’s functions are managed through a single, user-friendly platform. From this dashboard, you can assign tasks to the AI, validate its work, review audit logs, and access reports. This prevents the need to jump between multiple applications to manage your automated financial workflows.

Pros and Cons

Every tool has its trade-offs, and it’s important to weigh them against your specific business needs.

Pros:

- Direct Time Savings: By automating manual data entry and reconciliation, Numra frees up significant employee hours that can be reallocated to higher-value work.

- Improved Accuracy: The system reduces the potential for human error in financial calculations and data transfers, which can prevent costly mistakes.

- Cost-Effective Scalability: It allows your finance operations to handle a growing volume of transactions without a proportional increase in headcount.

- Enhanced Employee Satisfaction: Offloading monotonous tasks can reduce employee stress and burnout, leading to better morale and retention.

Cons:

- Implementation Time: Setting up the automations and integrations requires an initial time investment. This is not a plug-and-play solution and will take effort to configure correctly.

- Integration Hurdles: While it integrates with many systems, connecting to older, custom-built, or less common software may require technical assistance and could be complex.

- Learning Curve: To get the full value, users must learn how to effectively build and manage the automation workflows within the Numra platform.

Who Should Consider Numra?

Numra is most beneficial for small to medium-sized businesses where the finance team, which may only be one or two people, is consistently bogged down by manual, repetitive tasks. If you find your team spending more time on data entry, invoice processing, and reconciliations than on financial analysis and strategy, this tool is worth evaluating. It’s particularly useful for businesses experiencing growth, where transaction volume is increasing faster than the capacity of the current team. Companies that rely heavily on spreadsheets for their financial processes stand to gain the most immediate and tangible benefits.

Pricing and Plans

Numra operates on a freemium model, making it accessible for businesses to test its value before committing financially.

- Free Plan: This plan offers limited access to Numra’s core features, allowing a small business to automate a few key tasks and evaluate the platform’s effectiveness at no cost.

- Pro Plan: Starting at $12 per month, the Pro plan unlocks more advanced features, higher automation limits, and broader integration capabilities. This plan is designed for businesses ready to fully integrate AI automation into their daily financial operations.

For detailed specifics on feature limitations and volume caps, it is recommended to consult the official Numra website.

What makes Numra great?

Numra’s greatest strength is its ability to integrate directly with your current software, eliminating the need for a costly and disruptive system overhaul. Unlike solutions that demand you migrate your entire financial history to their proprietary ecosystem, Numra acts as an intelligent layer on top of what you already use. This approach drastically lowers the barrier to adoption for small businesses. There is no need to retrain the entire team on a new ERP or accounting platform. Instead, you can introduce automation incrementally, targeting the most painful and time-consuming processes first. This focus on compatibility makes it a practical, low-risk investment for improving operational efficiency.

Frequently Asked Questions

- How much technical skill is needed to set up Numra?

- Basic setup and simple automations can be configured by a user familiar with financial software. However, more complex integrations, especially with custom or legacy systems, may require some technical expertise or assistance from Numra’s support team.

- Is my company’s financial data secure with Numra?

- Numra emphasizes data security, providing features like robust internal controls and detailed audit logs. They employ security protocols to protect sensitive financial information, though it is always advisable to review their specific security and compliance documentation.

- What kind of customer support is available?

- Numra offers support resources through their website, including tutorials and guides. Paid plans typically include access to more direct support channels for troubleshooting and assistance with complex setups.

- Can Numra integrate with common SMB accounting software like QuickBooks or Xero?

- Numra is designed for compatibility and typically integrates well with major accounting platforms used by small and medium businesses. Its API connectivity allows for flexible connections, but you should always confirm direct integration capabilities for your specific software version.